The bench mentioned that the objective of amending the current law was compensatory in nature as it would augment funds and finance for ‘construction, maintenance, repair and upkeep’ of the roads of Himachal Pradesh.

The apex court has ruled that state governments can now impose lumpsum road tax on all public transport vehicles. The tax collected will be used to improve infrastructure facilities. The levy is slated to be compensatory in nature and, therefore, within the competence of a state legislature according to a report by the Economic Times.

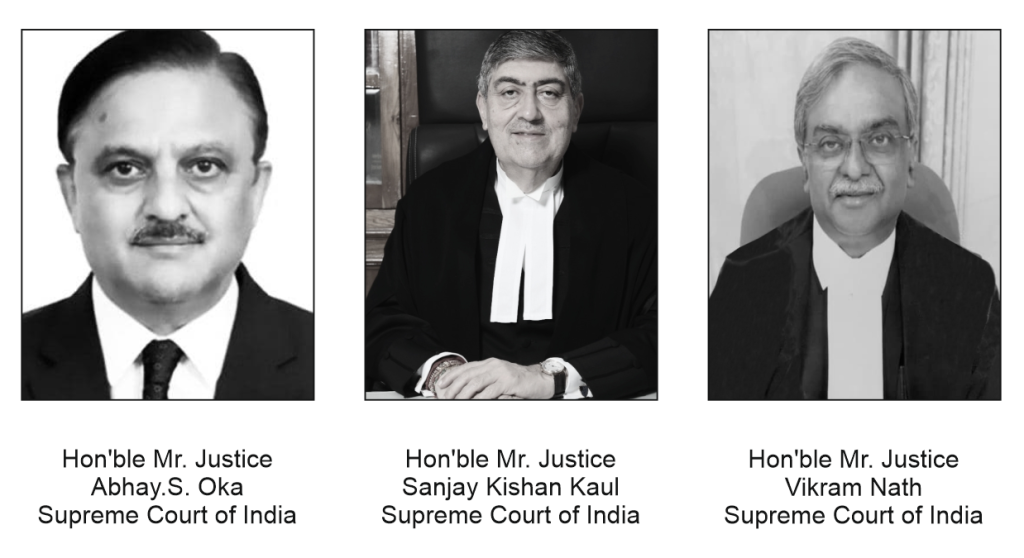

The verdict was given by a bench comprising of justices Sanjay K Kaul, Abhay S Oka and Vikram Nath. The ruling came out in favour of the the state of Himachal Pradesh. Previously the state’s high court had quashed the state government’s notifications issued in 2000 for levy of lumpsum taxes, and had held that it could not be levied on general assessment but as per actual default.

-

“This is a landmark judgment that recognises the power of the state to impose taxes for its development. This judgment will help the state to impose taxes for developing road and transport infrastructure. Now the state will be able to recover crores of outstanding dues,” ET said in its report citing Himachal Pradesh Additional Advocate Abhinav Mukerji.

-

The apex court said in the absence of any principles having been laid down by the Parliament, no fault could be found in the law enacted by legislature.

-

The bench mentioned that the objective of amending the current law was compensatory in nature as it would augment funds and finance for ‘construction, maintenance, repair and upkeep’ of the roads of Himachal Pradesh.

-

“Imposition of such additional special road tax was only to keep a check or a discipline on the transport vehicle operators… This could work as a deterrent for the transport operators to commit any breach and to follow the mandate of the law. Such additional special road tax could be termed as regulatory in nature to regulate other statutory provisions being implemented and strictly followed,” the Supreme court added.

-

Stating that there is no inconsistency with the provisions in the Central enactment, the judges said state legislatures have the power to levy taxes not only under Entries 56 and 57 but also to lay down the principles under Entry 35 of List III the judgement by the Supreme court said.

Source: MoneyControl