“Our Constitution reflects a value which equates education with charity. That it is to be treated as neither business, trade, nor commerce, has been declared by the pronouncement of this very court”

Supreme Court on Wednesday said profit-oriented educational trusts or societies cannot claim exemption under the Income Tax Act.

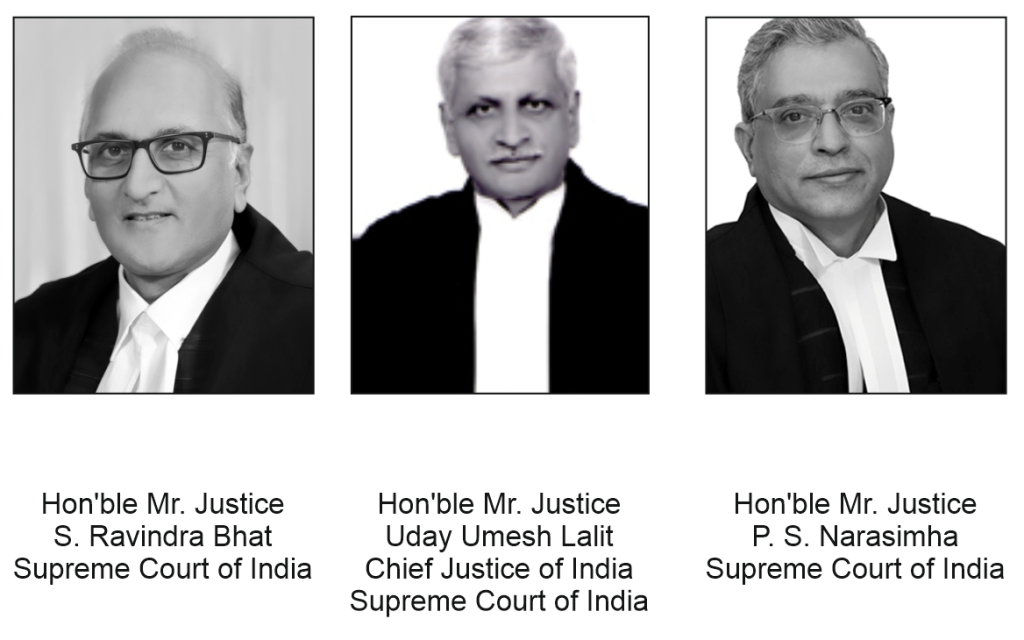

The bench of Chief Justice of India UU Lalit, Justices S Ravindra Bhat and PS Narasimha said that such educational trusts or societies should solely be concerned with education or education related activities under Section 10(23C) of the Income Tax Act(the Act).

The Section states that any university or other educational institution existing solely for educational purposes and not for purposes of profit, and which is wholly or substantially financed by the Government qualify for tax exemption under the said section.

“Our Constitution reflects a value which equates education with charity. That it is to be treated as neither business, trade, nor commerce, has been declared by the pronouncement of this very court,” the court said.

The order came after several educational trusts moved the Supreme Court against the Andhra Pradesh High Court order.

The HC order said the trusts in question were not created solely for education and were not entitled to claim exemption under the Act.

The conclusions of this court are summarized as follows:

-

All objects of the society, trust etc., must relate to imparting education or be in relation to educational activities to qualify for exemption.

-

Where the objective of the institution appears to be profit-oriented, such institutions would not be entitled to approval under Section 10(23C) of the IT Act.

-

The seventh proviso to Section 10(23C), as well as Section 11(4A) refer to profits which may be ‘incidentally’ generated or earned by the charitable institution. In the present case, the same is applicable only to those institutions which impart education or are engaged in activities connected to education.

-

The reference to ‘business’ and ‘profits’ in the seventh proviso to Section 10(23C) and Section 11(4A) merely means that the profits of business which is ‘incidental’ to educational activity – as explained in the earlier part of the judgment i.e., relating to education such as sale of text books, providing school bus facilities, hostel facilities, etc.

-

While considering applications for approval under Section 10(23C), the Commissioner or the concerned authority as the case may be under the second proviso is not bound to examine only the objects of the institution. To ascertain the genuineness of the institution and the manner of its functioning, the Commissioner or other authority is free to call for the audited accounts or other such documents for recording satisfaction where the society, trust or institution genuinely seeks to achieve the objects which it professes.

-

It is held that wherever registration of trust or charities is obligatory under state or local laws, the concerned trust, society, other institution etc. seeking approval under Section 10(23C) should also comply with provisions of such state laws. This would enable the Commissioner or concerned authority to ascertain the genuineness of the trust, society etc.

The court said that the above order would apply prospectively.

Source : Business Standard