Order passed by National Company Law Tribunal under section 31 of Insolvency and Bankruptcy Code, 2016 has overriding effect over anything inconsistent contained in Income-tax Act and it shall be binding on all respective entities including other stakeholders, which include Central Government.

-Moserbaer India Ltd. Vs DCIT (ITAT Delhi)

In examining the interplay of Insolvency and Bankruptcy Code vis-à-vis the tax statutes and its impact on the latter, it is relevant to refer to the non-obstante clause in the Insolvency and Bankruptcy Code under Section 238 which stipulates:

Section 238 of IBC: Provisions of this Code to override other laws- The provisions of this Code shall have effect, notwithstanding anything inconsistent therewith contained in any other law for the time being in force or any instrument having effect by virtue of any such law.

IMPACT OF SECTION 238 AS INTERPRETED BY THE COURTS

The problem of overriding effect was first brought up in the case of Innoventive Industries Limited v. ICICI Bank Limited (August 2017 Judgment), the financial creditor filed a claim due to a default in payments on financing extended to Innoventive Industries.

- Insolvency Code brings a paradigm shift in law including a need to remove the management of a corporate debtor which defaults on its debts. Thus, entrenched managements are no longer allowed to continue in case of non-payment of debts.

- The NCLT issued a moratorium and appointed an Insolvency Resolution Professional based on the overriding implications of the IBC over the MRUA (IRP). NCLAT held in the appeal that there is no conflict between MRUA and IBC because of the IBC take precedence over those of the MRUA. On the issue of inconsistency between the provisions of the Code which is a central legislation and the MRU Act, which is a state legislation, relying upon Article 254 of the Constitution of India, 1950 which recognises supremacy of central laws over state laws The Supreme Court upheld the interpretation by ruling that the non-obstante provision of the IBC would prevail over the non-obstante clause of the MRUA in an appeal against the NCLAT judgment.

-

It was held that due to the non-obstante provision in the IBC, any right of the corporate debtor under any other law could not come between the IBC and the relief order.

- The Apex Court after hearing the parties before it observed that under Section 17(b) of the Code, once an interim insolvency resolution professional has been appointed, the powers of the board of directors stand suspended and the erstwhile directors are no longer in the management of the company. Therefore, subsequent to the appointment of the interim insolvency professional, the erstwhile directors do not have any right to maintain an appeal on behalf of the company even if it pertains to challenge against the order of NCLT in terms of the provisions of the Code.

In the matter of Leo Edibles & Fats Ltd. v. Income tax department, the court addressed the question of the IBC’s overriding impact over the Income Tax Act in determining the dues of the Income TAX Authority during liquidation.

- The income tax authority could no longer claim a priority in respect of clearing of tax dues under the Income Tax Act if the assessee company is undergoing liquidation under IBC.

- The high court further stated that assests under attachment (even if encumbered) will not generate a secured creditor interest in favor of the Income Tax Authority under the IBC.

- It was further stated that the moratorium in terms if processes established under the IBC guarantees that any outstanding lawsuit begins before the bankruptcy proceeding is stopped.

- Assets subject to an order of attachment issued before the liquidation, commencement shall be auctioned along with the assesseee company’s other unencumbered assets.

Pr. Commissioner of Income Tax v. Monnet Ispat and Energy Ltd.[ Special Leave to Appeal (Civil) No. 6483/2018 the supreme court confirmed that anything incongruous in any other statute, including the Income Tax Act, shall be overridden by Section 238 of the Insolvency and Bankruptcy Code, 2016.

In the case of Jag Mohan Bajaj v. Shivam Fragrances Pvt. Ltd. & others, the NCLAT found that the IBC is a unique law that has precedence over other laws. The corporate insolvency resolution process state date could not be postponed due to an ongoing internal disagreement between Corporate Debtor’s directors over charges of oppression and mismanagement. Financial creditor’s statutory rights could not be curtailed due to pending Oppression and Mismanagement lawsuits under section 241 and 242 of the Companies Act 2013.

In view of the matter, section 238 of the Code will have overriding effect over all other Central and State statutes including the Income-tax Act and all the claims including claim of the Income-tax Department under the Income-tax Act, 1961 shall be entertained by the Official Liquidator u/s 53 (1) of the Code.

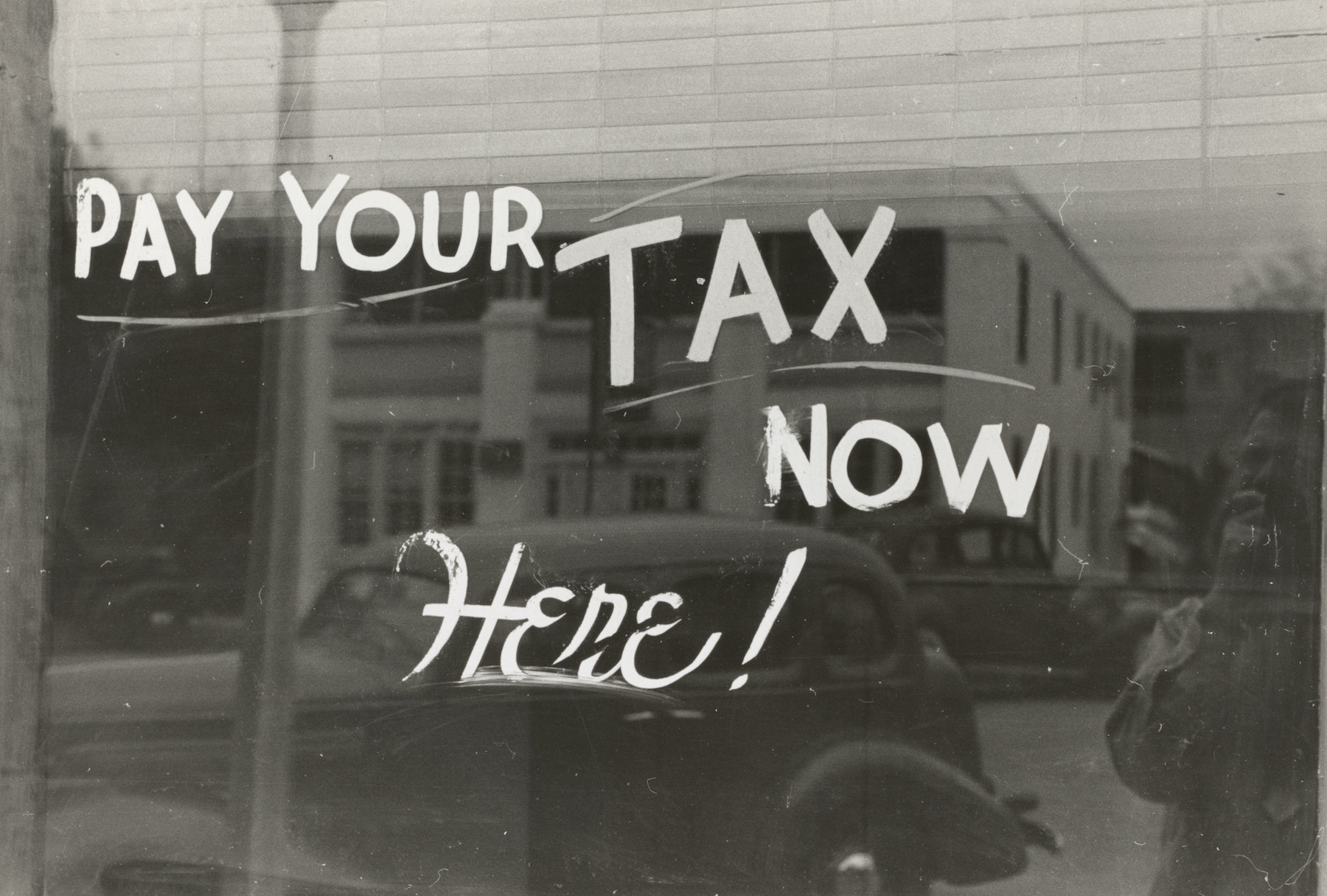

Photo by The New York Public Library on Unsplash