Merger and Amalgamation

Amalgamation is the consolidation or combination of two or more companies known as the amalgamating companies usually the companies that operate in the same or similar line of business to form a completely new company whereas a merger refers to the consolidation of two or more business entities to form one single joint entity with the new management structure and new business ownership where both the entities join hands and decide to merge together as one unit with a new name to gain the competitive advantage and synergies in operations.

Mergers are primarily supervised by the High Court(s) and the Ministry of Company Affairs. The SEBI regulates takeovers of companies that have shares listed on any stock exchange in India. The 2013 Act creates a new regulator, the National Law Company Tribunal (“Tribunal“) who, upon its constitution, will assume jurisdiction (the High Courts will no longer have any jurisdiction) of the court for sanctioning mergers.

Cross-border mergers

The 1956 Act permits cross-border mergers only where the transferor is a foreign company. In contrast, the 2013 Act permits in-principle mergers between an Indian and a foreign company located in a jurisdiction notified by the central government in periodic consultation with RBI. Such a merger would be subject to RBI approval and Scheme may provide payment in cash or depository receipts or both. The Income Tax Act presently grants tax exemptions on mergers if the transferee is an Indian company and does not recognize a situation where the transferee will be a foreign company, as contemplated under the 2013 Act.

A merger of small companies and holding with wholly-owned subsidiaries

Unlike the 1956 Act under which merger of all companies, irrespective of nature and size requires court approval, the 2013 Act carves out a separate procedure for small companies and the holding and wholly-owned subsidiaries. Section 233 of the 2013 Act prescribes a simplified fast track procedure for their merger which requires the consent of shareholders holding 90% in value and creditors representing 9/10th of debt in value as well as approval of the Scheme by the Regional Director, Ministry of Corporate Affairs in case no objections are received from the Official Liquidator and Registrar of Companies. Approval of the Tribunal is not required for such mergers.

De-merger

De-Merger means split or division of a business or any undertaking of Company and makes them separate unit or undertaking. In short, De-Merger means the separation of a Large Company into one or more small companies. Section 232 of Chapter XV of Companies Act 2013 deals with mergers and amalgamation including demergers.

De-merger is not defined specifically in the Companies Act, 2013. However, an explanation is given to section 230(1) of the said Act prescribes it as an arrangement for the reorganization of the company’s share capital by:

- Consolidation of shares of different classes

- Division of shares of different classes

- Or both

A demerger is mentioned in section 2(19AA) of the Income Tax Act, 1961, subject to fulfilling the conditions stipulated in section 2(19AA) of the Income Tax Act and shares have been allotted by the ‘resulting company’ to the shareholders of the ‘demerged company’ against the transfer of assets and liabilities

Generally, the memorandum of association of both the companies should be examined to check about the availability of companies power to amalgamate clause. Then, stock exchanges of both merging and merged companies should be informed about the merger proposal. The draft merger proposal is to be approved by the board of directors, once the same is approved by respective boards, each company shall make an application to the appropriate court of the state in which the registered office is situated in Form No. 36 so that companies can follow the further procedure as per sections 230 to 234 of the Companies Act, 2013 (earlier section 390 to section 396A of the Companies Act, 1956).

Acquisitions to which Take Over Code Does not Apply

The Takeover Code, which sets out procedures governing any attempted takeover of a company that has its shares listed on one or more recognized stock exchange(s) in India. The Takeover Code, however, does not apply to the following acquisitions:

- Allotment of shares made in public issue or in right issue;

- Allotment of shares to underwriters in pursuance of underwriting agreement;

- Inter-se transfer between the group, relative, foreign collaborators and Indian promoters who are shareholders, acquirer and persons acting in concert with him;

- Acquisition of shares in the ordinary course of business by a registered stockbroker on behalf of his client, market maker, public financial institutions in their own account, banks and financial institutions as pledgees, international financial institutions, and merchant banker or promoter of the target company under a scheme of safety net;

- Exchange of shares received in a public offer made under the Takeover Code;

- Transmission of shares in succession or inheritance;

- Acquisition of shares by government companies and statutory corporations. However, acquisition in a listed public sector undertakings, through the process of competitive bidding process of the Central Government is not exempted;

- Transfer of shares by state-level financial institutions to co-promoters under an agreement;

- Transfer of shares venture capital funds or registered venture capital investors to a venture capital undertaking or to its promoters pursuant to an agreement;

- Acquisition of shares in pursuance of a scheme of rehabilitation of a sick company, amalgamation, merger or demerger;

- Acquisition of shares of an unlisted company. However, if such acquisition results in acquisition or change of control in a listed company, the exemption will not be available;

- Acquisition of global depository receipts and American depository receipts so long as they are not converted into shares carrying voting rights.

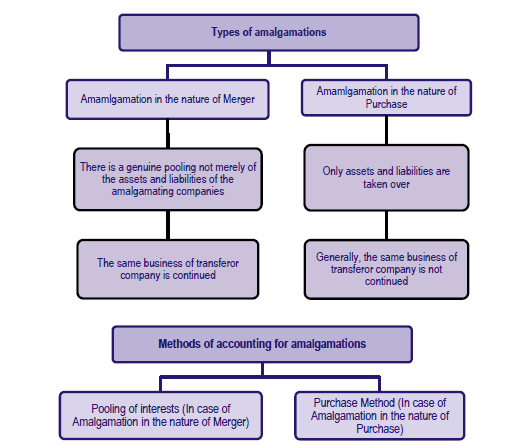

Types of Amalgamation

Amalgamation may be either by the transfer of two or more undertakings to a new company or by the transfer of one or more undertakings to an existing company.

Chapter XV covering Section 230 to 240 of Companies Act, 2013 deals with the provisions related to the Compromises, Arrangements and Amalgamations.

Provisions relating to Merger, Amalgamation

Chapter XV (Section 230 to 240) of Companies Act, 2013(the Act) contains provisions on ‘Compromises, Arrangements and Amalgamations’, that covers compromise or arrangements, mergers and amalgamations, Corporate Debt Restructuring, demergers, fast track mergers for small companies/holding subsidiary companies, cross border mergers, takeovers, an amalgamation of companies in public interest etc.,

The new Act provisions in relation to different types of restructuring processes are as follow:

- Compromise or Arrangements under Section 230 & 231 of the Act.

- Amalgamation including demergers falls within section 232 of the Act.

- The amalgamation of small companies within section 233 of the Act.

- The amalgamation of foreign companies under section 234 of the Act.

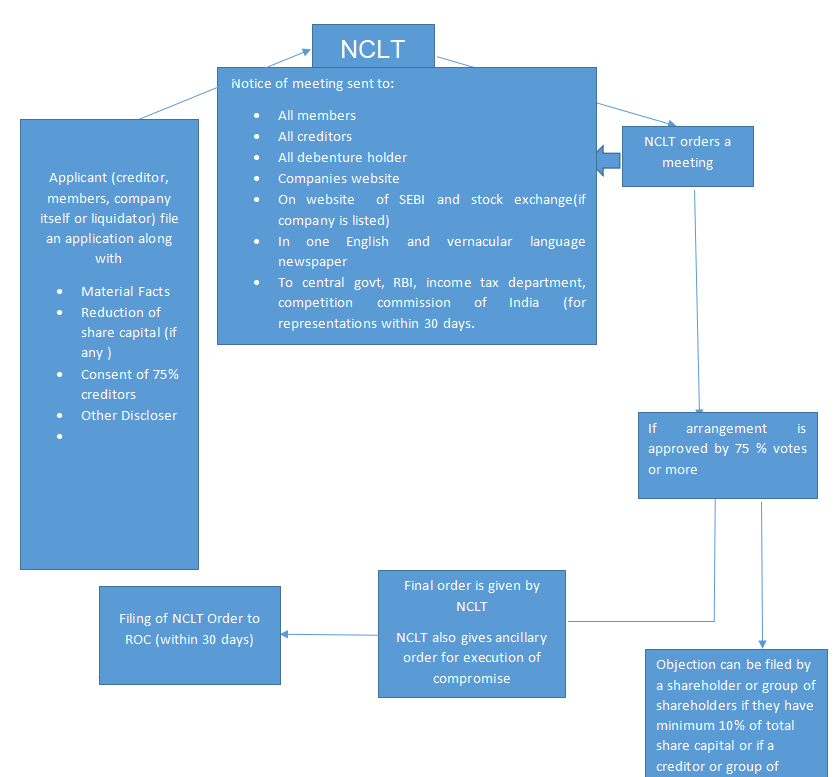

Section 230 of the Companies Act, 2013 deals with the basic procedures to be followed for any compromise and arrangement, meetings of creditors, members and security holders for approval of the Power of NCLT.

Section 231: Power of Tribunal to enforce compromise or arrangements made under section 230

According to this section, NCLT can supervise the implementation of the compromise or arrangements. The tribunal can give further direction and if it is of the opinion that the company cannot implement the direction then it can order for winding up of the company.

Section 232: Merger and Amalgamation of Company

If the application is filed under section 230 involve a merger or Amalgamation then along with the procedure given under sec. 230, some additional documents are to be filed which are as follows:

1. Along with the notice of meeting a draft scheme of merger or amalgamation and report of the effect of such merger on each class of shareholder are to be filled. A report of valuation and other discloser was to be sent along with a notice of meeting.

2.While passing the final order NCLT also make provisions for merger or amalgamation.

Section 233: Merger or Amalgamation of certain companies

Under this section, certain companies mean two or more small companies or mergers between a holding and its wholly-owned subsidiary company and such other class of companies as may be prescribed by the central government.

This section attracts only if the following conditions is fulfilled 1.Invites objections/suggestion from ROC liquidator or person effected by the scheme. 2.Scheme is approved by shareholders by 90% majority.

3.File declaration of solvency to ROC. 4.Scheme is approved by creditors by the majority of 90%. If above mention steps are fulfilled then 5.Scheme send to central government and ROC for objection or suggestion.

6. If there are any objections or suggestions then ROC has to communicate to the central government within 30 days.

7.If the central government find that the scheme is public interest and in the interest of creditors then approved it and communicate to ROC but if government disapprove of the scheme then it returns to NCLT and the procedure of section 232 shall be applied.

Section 234: Merger or amalgamation of company with a foreign company

Under this section additional to section 232 the approval of RBI has to be obtained and the scheme must provide for the manner of consideration. (Cash/ depository receipt/ combination)

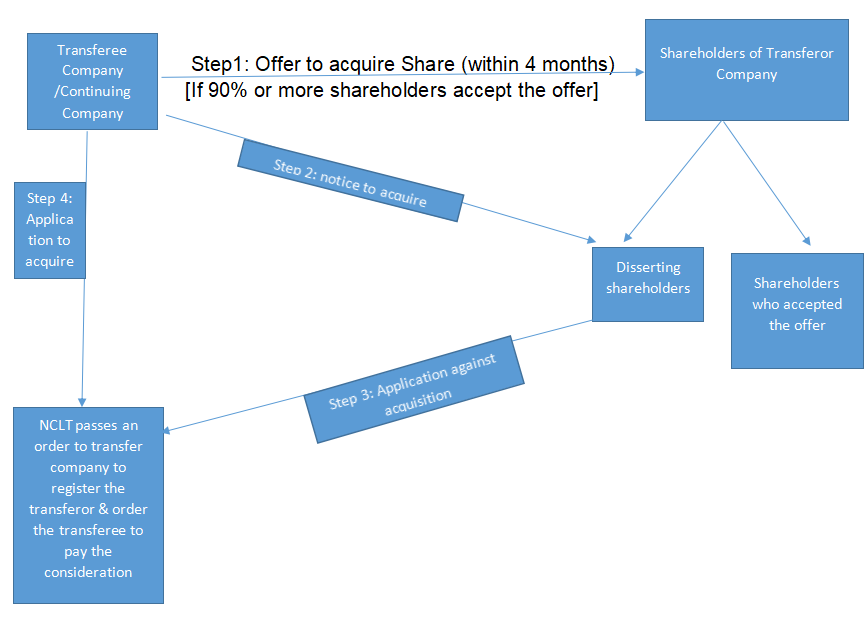

Section 235: Power to acquire shares of shareholders deserting from scheme approved by majority.

Section 236: Purchase of minority shareholding If the purchaser has more than 90% of the share then this section gives the purchaser a right to hold the rest of the shares.

Section 237: Power of central government to provide for amalgamation in the public interest.

Section 238: Registration of offer of a scheme involving the transfer of shares.

This section provides for the registration of a scheme for acquiring shares with ROC. Section 239 talks about the preservation of books and papers of amalgamated companies. According to this section books and papers of amalgamated companies cannot be disposed of unless the central government approves them.

Section 240 Put liabilities on the officers of the amalgamated company in respect of offences committed prior to merger or acquisition.

Add Comment